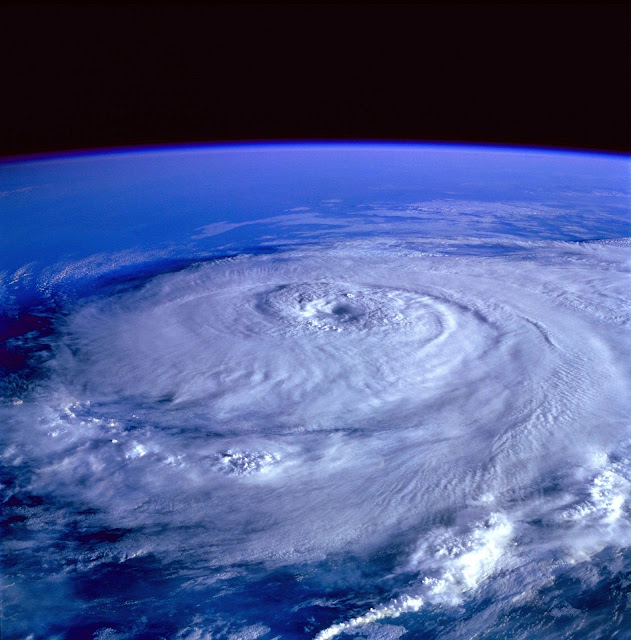

The Calm Before the Storm

There’s

a commercial for a mortgage company that plays regularly on a podcast that I

like to follow. In this commercial you

hear the question, “Why can’t people get a decision on their mortgage in

minutes rather than having to wait weeks?”

Kudos to the copywriter of the ad for keying on our penchant to have

things instantly instead of having to wait.

In today’s day and age, we take photos with our phones and see them

instantly (and most likely never view them again until we’re looking to free up

storage space on our phones).

Conversely, it wasn’t THAT long ago that there was this thing called

“film” that went inside a camera (that had no way of making phone calls), and

you had to take the film to a place that developed it and printed the photos on

PAPER –

and we would wait a few DAYS to get those prints back to see that we had our

thumb in front of the lens in five of the shots and seven other photos were

completely blurry and unrecognizable (and we paid for ALL of the developed photos). We

were such barbarians!

a commercial for a mortgage company that plays regularly on a podcast that I

like to follow. In this commercial you

hear the question, “Why can’t people get a decision on their mortgage in

minutes rather than having to wait weeks?”

Kudos to the copywriter of the ad for keying on our penchant to have

things instantly instead of having to wait.

In today’s day and age, we take photos with our phones and see them

instantly (and most likely never view them again until we’re looking to free up

storage space on our phones).

Conversely, it wasn’t THAT long ago that there was this thing called

“film” that went inside a camera (that had no way of making phone calls), and

you had to take the film to a place that developed it and printed the photos on

PAPER –

and we would wait a few DAYS to get those prints back to see that we had our

thumb in front of the lens in five of the shots and seven other photos were

completely blurry and unrecognizable (and we paid for ALL of the developed photos). We

were such barbarians!

There’s

nothing wrong with wanting to have things instantly. Don’t worry: I’m not going to wax poetic

about the virtues of waiting and how it makes things so much more worthwhile –

I’d probably lose all three of the people who regularly read this article if I

did. What I am going to do is tell you

what the commercial doesn’t tell you: getting an “instant” decision on your

mortgage IS possible, but it’s not done with the wave of a magic wand –

YOU, the buyer, have to have everything ready.

Think of what I’m about to list as your mortgage “bug-out bag” (that bag

of essentials you have pre-packed and ready so you can escape a bad situation

at a moment’s notice). Here’s what you

need:

nothing wrong with wanting to have things instantly. Don’t worry: I’m not going to wax poetic

about the virtues of waiting and how it makes things so much more worthwhile –

I’d probably lose all three of the people who regularly read this article if I

did. What I am going to do is tell you

what the commercial doesn’t tell you: getting an “instant” decision on your

mortgage IS possible, but it’s not done with the wave of a magic wand –

YOU, the buyer, have to have everything ready.

Think of what I’m about to list as your mortgage “bug-out bag” (that bag

of essentials you have pre-packed and ready so you can escape a bad situation

at a moment’s notice). Here’s what you

need:

•Valid

ID and Social Security Card (Passport or Birth Certificate is acceptable) for

all borrowers

ID and Social Security Card (Passport or Birth Certificate is acceptable) for

all borrowers

•Most

recent pay stubs for the past 30 days

recent pay stubs for the past 30 days

•Most

recent two years’ W2s and/or 1099s

recent two years’ W2s and/or 1099s

•Most

recent two years’ Federal tax returns

recent two years’ Federal tax returns

•Two

most recent bank statements (with ALL numbered pages)

most recent bank statements (with ALL numbered pages)

•Current

401(k) or Retirement Account statement

401(k) or Retirement Account statement

•Divorce

Decree (if applicable)

Decree (if applicable)

•Bankruptcy

Discharge (if applicable) or Complete Bankruptcy Filing (if applicable)

Discharge (if applicable) or Complete Bankruptcy Filing (if applicable)

•Veteran’s

DD214 (VA loan), Commanding Officer’s Information (active military)

DD214 (VA loan), Commanding Officer’s Information (active military)

•Pension/Social

Security Income Award Letter (if applicable)

Security Income Award Letter (if applicable)

•Annuity

Distribution Letter (if applicable)

Distribution Letter (if applicable)

As

you can see from the list above, these are all things that you should be able

to access without a problem –

we’re not asking for copies of your third-grade report card or proof that you

won the tri-county funnel cake eating contest.

If you have these items easily accessible, you can get a decision on a

mortgage very quickly. If you don’t,

though, then that decision will drag on and on until you gather them up and get

them to your mortgage company. It’s

completely up to you.

you can see from the list above, these are all things that you should be able

to access without a problem –

we’re not asking for copies of your third-grade report card or proof that you

won the tri-county funnel cake eating contest.

If you have these items easily accessible, you can get a decision on a

mortgage very quickly. If you don’t,

though, then that decision will drag on and on until you gather them up and get

them to your mortgage company. It’s

completely up to you.

In

today’s seller’s market –

where the good homes are going under contract as quickly as they’re appearing

on the MLS (or even before) –

you WANT to have your “bug-out bag” current and ready. If not, you’re going to have to weather the

storm with no roof over your head.

today’s seller’s market –

where the good homes are going under contract as quickly as they’re appearing

on the MLS (or even before) –

you WANT to have your “bug-out bag” current and ready. If not, you’re going to have to weather the

storm with no roof over your head.